The visionary Treasury role inside the Bank Organisation – Part II

by Leonardo Orlando

Last time we focused on how the Treasury role inside the Bank Organisation has evolved over the past 10 years, going from a “passive” business centric role to a more “active” risk based one.

Treasury role has changed due to the new market context and related regulatory framework. This has made liquidity monitoring and control, one of the Bank’s organisation core pillars.

As already mentioned in previous writings, liquidity crisis during Lehman Brothers crash, has shown liquidity system weakness, related to the following main reasons:

- In the trading market, “domino effect” is quite relevant and sensitive. Currently market is composed by few big players, which are able to make market aversion profile change rapidly

- Customer risk aversion profile has changed as well. Common investment attitude has moved from medium-long term to short term timeline, then affecting the maturity ladder management

- Risk profile has impacted also on portfolio management, making Bank margin per transaction lower. As a consequence, Banks have been assuming a more active role in the market, losing the original “intermediary” profile. Banks have started taking position in the market, then assuming a completely different risk profile.

The combination of the three above elements has generated the need for a solid and stronger risk adjusted view, which aggregates all risks, creates a single view on the Bank’s risk exposure and then provides guidelines on portfolio management.

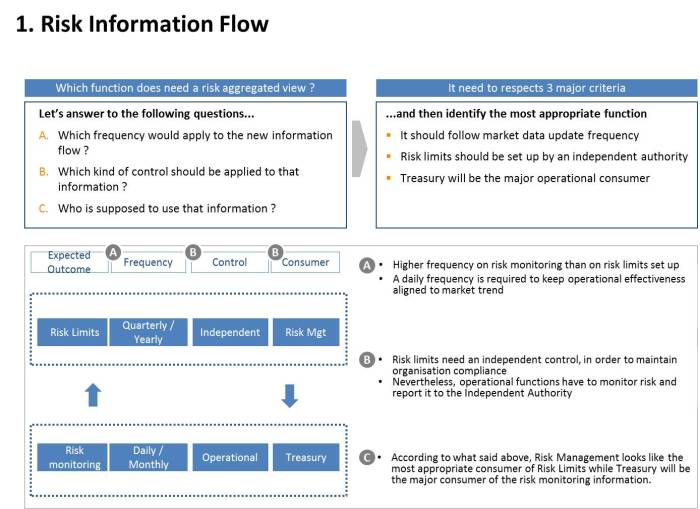

Now, the key question comes easy: Which function does need a risk aggregated view ?

Before of answering to that question I will provide an answer to the followings:

- Which frequency would apply to the new information flow

- Which kind of control should be applied to that information

- Who is supposed to use that information

- The risk aggregation view frequency should follow the market data refresh process, which in theory could occur on a daily basis. It implies that Bank’s risk profile should change daily, according to the market data. In a big Organisation, this becomes almost impossible to manage, if you just think about all implied changes and the uncertainty that it will generate. Then a good compromise would be to have a one off risk profile framework set up, which can occur on a quarterly basis and then a risk profile adjustment which can occur on a daily basis, according to the risk profile and the predefined threshold.

- Risk limits should be set up from an independent authority, which should control that predefined thresholds are respected on an on-going basis. The function in charge of the daily monitoring and control of risk should be then able to identify the risk implied by all transactions executed by the Bank and be able to realise when thresholds have been reached. At the same time an independent function should be able to have control of that information, even if at a less granular level, then being able to enforce policies and procedures to respect the predefined risk limits.

- Consumers of the risk aggregated view could be multiples, for different scope. For example, Treasury would need that information since it will be useful to know the risk implied by trades while Risk Management would need an aggregated risk view in order to identify consistency between risk taken and risk profile.

Having said that, Treasury needs to be recognised like the operational function which needs for the aggregated risk view, in order to monitor and control risk on a daily basis and provide continuous feedback to Risk Management.

So, even if Risk Management remains the independent function responsible for the overall risk management framework, Treasury plays a crucial role inside the defined framework, translating it into operational control and performing a risk adjusted portfolio analysis.

In the next article we will explain what portfolio analysis means and how it can be implemented.